401k rollover to roth ira tax calculator

You can use our IRA Contribution Calculator or our Roth vs. It is also possible to roll over a 401k to an IRA or another employers plan.

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Grow Crypto Gains Tax Free with Roth 401k.

. If you roll over your 401k into an IRA youll also want to consider the kind of rollover you need. Find out how much you can contribute to your Solo 401k with our free contribution calculator. Rollover distributions are exempt from tax when you place the funds in another IRA account within 60 days from the date of distribution.

Pros You can roll Roth 401k contributions and earnings directly into a Roth IRA tax-free. Heres how to do a 401k rollover in 4 steps without a tax bill. We can also help with Roth IRA and 401k conversions.

Enter a few step-by-step details in our Roth vs. Rollover Real Estate from the IRA LLC to the Solo 401k. Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest Salary 401K Interest Rate Sales Tax More.

A traditional IRA is a tax-deferred retirement savings tool. As your income increases the amount you can contribute gradually decreases to zero. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with.

Moving after-tax money into a Roth IRA can help diversify retirement portfolios. Regarding reporting 401K rollover into IRA how you report it to the IRS depends on the type of rollover. Lump-sum Distribution The withdrawal of funds from a 401k.

Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. Another method is to do a 60-day rollover. First lets assume your husbands annuity is funded with IRA or 401k money.

You can also convert non-Roth assets pre-tax and after-tax assets at the time of roll over into a Roth IRA but you would owe income tax on the pre-tax. Typically these limits change each year. 401k Withdrawing money from a 401k early comes with a 10 penalty.

401k traditional IRA or Roth IRA. You may be able to roll over. Or take advantage of potential tax benefits today with a Traditional IRA.

You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a 401k into a Roth IRA. Penalties The payment demanded for not adhering to set rules. Roth IRAs have income limits.

If you chose a Roth IRA for your rollover. A Rollover IRA is a retirement account that allows you to move funds from a 401k from a previous employer to an IRA. With a Roth 401k youll likely be more interested in a Roth IRA so that you can.

Learn more about the pros and cons of your choices for rolling over your 401k. No as the Roth IRA rules do not permit for the transfer of Roth IRA funds to a Roth 401k including a ROTH solo 401k. This is a Roth IRA rule.

Both Roth and traditional IRAs generally offer more investment options. And the penalties and taxes you have to pay on that money depend on the type of retirement account it came from. Learn about Roth IRA conversion.

Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rulesThis is much different than a Traditional IRA which taxes withdrawalsContributions can be withdrawn any time you wish and there are no required. RCH Auto Portability is the enhanced standard of care for an automatic rollover program reducing cashouts by 52 while helping participants receiving mandatory distributions. Decide if you want to manage the investments in your IRA or have us do it for you.

Regarding rolling 401K into IRA you should receive a Form 1099-R reporting your 401K distribution. Traditional IRA comparison page to see what option might be right for you. So he owns what I call an IRA annuity.

Roll over your 401k to a Roth IRA If youre transitioning to a new job or heading into retirement rolling over your 401k to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free. As a result the assets in your retirement account remain tax-deferred. The Roth solo 401k account can only accept rollover contributions from another Roth 401k Roth 403b Roth TSP or Roth 457b account.

Investment and Insurance. The Roth 401k brings together the best of a 401k and the much-loved Roth IRA. FAQ Bitcoin In the Solo.

The 401ks annual contribution limit of 20500 in 2022 27000 for those age 50 or older. Traditional IRA contribution limits are based on how you file your taxes. Now if his annuity has a liquidity or withdrawal feature he could request a transfer of its cash value into an IRA or 401k account that he owns.

Rollover Moving the 401k contribution to another retirement fund option often an IRA. How to Rollover a 401K. Rollover IRA401K Rollover Options.

A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. No taxes will be imposed on rollovers. As soon as those 60 days are up the money from the IRA is considered to be cashed out.

Early Withdrawal Costs Calculator first. State Income Tax Rate The percentage of taxes an individual has to pay on their income according to the laws of their state. I think what you are asking is whether he can transfer money to your 401k tax-free.

Please verify with your plan administrator that your distribution is eligible for a rolloverconversion. To lean more about this Roth IRA rule CLICK HERE. The Average 401k.

We will help you understand the potential considerations of what a 401k has to offer so you can make a more informed decision about what is right for you. Is a Roth. Save on taxes and build for a bigger retirment.

Into a Roth IRA. Traditional IRA Calculator to see which type of retirement account may be right for you and how much you can contribute. Rolling over a 401k.

A rollover IRA is typically.

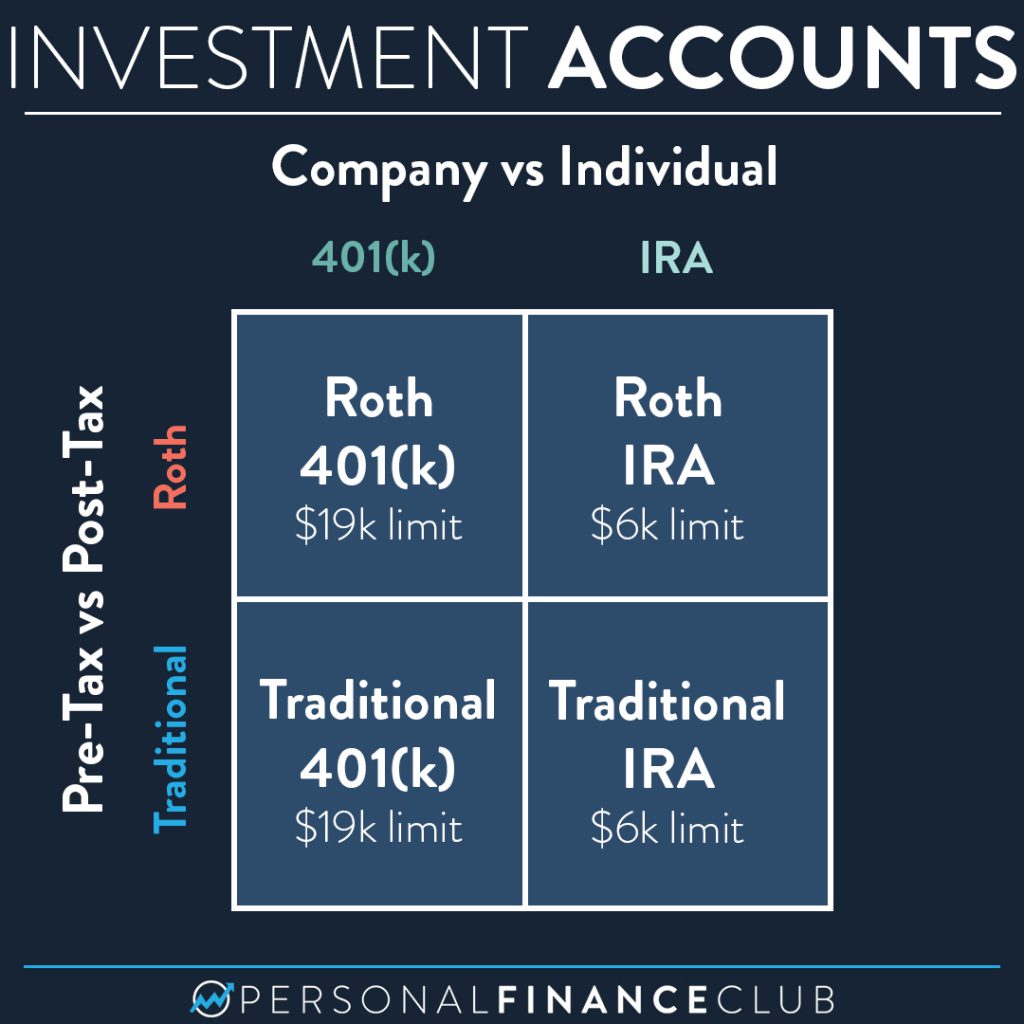

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Traditional Vs Roth Ira Calculator

Solo 401k My Solo 401k Financial

Roth 401k Roth Vs Traditional 401k Fidelity

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

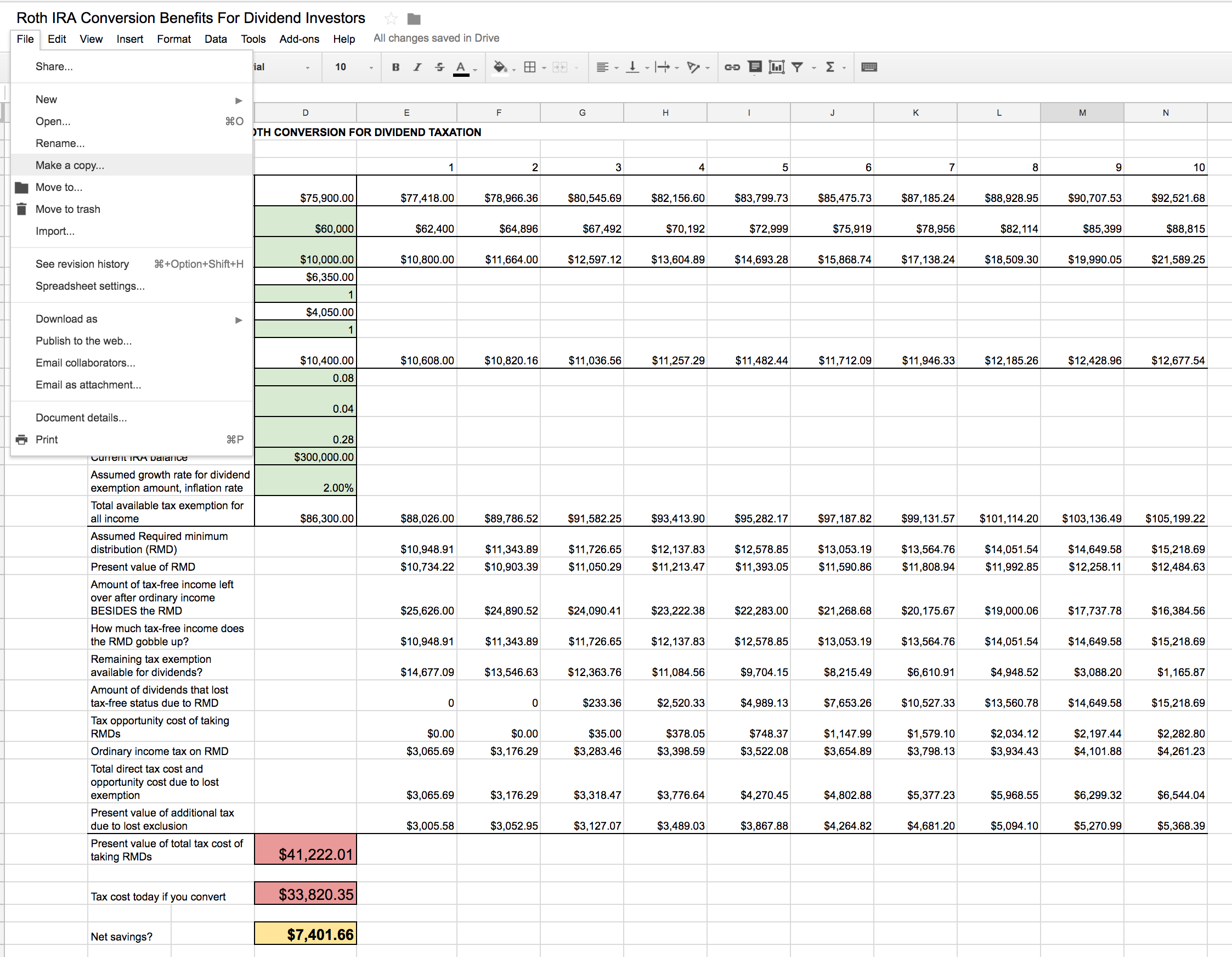

Roth Ira Conversion Spreadsheet Seeking Alpha

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

After Tax 401 K Contributions Retirement Benefits Fidelity

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Traditional Vs Roth Ira Calculator

The Ultimate Roth 401 K Guide District Capital Management

Roth Conversion Q A Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Systematic Partial Roth Conversions Recharacterizations

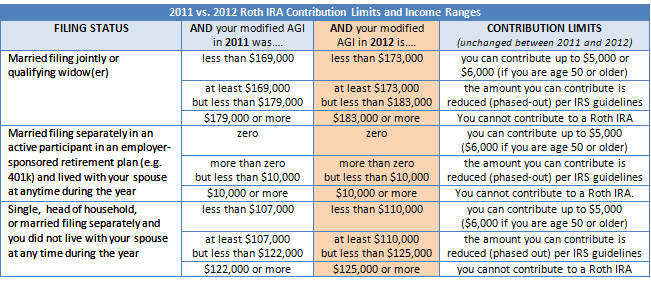

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Conversion Ira